Summary of roundtable with the Royal Society of Edinburgh, to inform thinking into how Scotland can continue to foster innovation and aid the commercialisation of research.

Strengths and barriers of the Scottish landscape for commercialisation of research

06 Aug 2019

CaSE held a roundtable discussion with the Royal Society of Edinburgh focusing on the innovation landscape in Scotland and the context of this within the rest of the UK. Opportunities for research-led innovation in Scotland and how they might be maximised to meet the goal of increasing UK research intensity to 2.4% GDP by 2027 were also explored. The discussion was attended by a dozen senior actors in Scotland’s research and innovation sector.

Read more about our work on Place here.

1. Introduction to the session

The roundtable was set against the backdrop of the UK Government’s aim to increase R&D intensity in the UK to 2.4% of GDP by 2027. The thrust of the input target is to enhance the environment for science and engineering in the UK and to improve productivity and the lives of those in the UK and beyond. CaSE has already been highly active in this area, working to understand what would be required of the public sector in reaching the target, and engaging with private enterprise to understand how the UK can be the most attractive to R&D intensive businesses.

CaSE trustee, Professor Lesley Yellowlees, provided an in-depth background to help shape the discussion. Scotland’s research quality is excellent but has not grown at the same rate as the rest of the UK or other competitor countries. Scotland’s share of Research Council funding has been decreasing, from 15.6% in 2012 to 14.5% in 2017. This 2017 level still puts Scotland ahead of the rest of the UK in terms of Research Council funding per capita, but it is important to assess why Scotland is slipping. Scottish Higher Education (HE) has been slipping down league tables, as is the rest of the UK, as competition from Asia/Australasia in particular has been increasing.

Scotland must be clever about how it uses investment in R&D but does well considering the funding it receives. Scotland has the highest ratio of publications to population levels, has a high number of STEM staff numbers and income, and a recent SSAC report has showed that the highest number of publications are in STEM. Scottish research has been more collaborative than others and has a higher proportion of EU students and staff than the rest of the UK.

Expenditure on R&D is growing but needs to catch up to the UK average. There are issues with productivity dynamics, 98.3% of enterprise have fewer than 50 employees, while 0.6% employ 40% of all staff in research and innovation in Scotland. Innovation funding, innovation centres and innovation vouchers are all frameworks Scotland is using to facilitate partnerships between academia and business that are working well. UK bodies, such as the newly-formed UKRI, support research and innovation and Scotland must ensure it plays a large part. Brexit and internationalisations are a cause for concern for the Scottish research landscape and remaining competitive internationally. Scotland should learn lessons from other regions of the UK is working collaboratively, taking notes from Northern Powerhouse network and Golden Triangle.

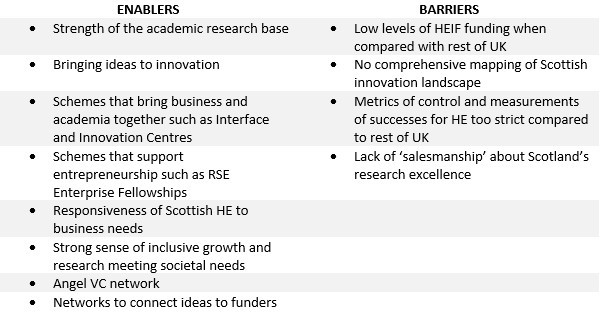

Summary of current enablers and barriers in Scottish innovation landscape

2. Strengths of Scottish Landscape for commercialisation of research

The first strength was said to be the enabling nature of the research base to fuel technology in centres of excellence. The trends of UK research funding have meant that there is more money available for a fewer number of projects, resulting in smaller universities often finding it more difficult to win research funding and meaning that research may not have direct economic or societal benefits. However, Scotland has a good track record for bringing ideas to innovation. Scotland lends itself to having small areas of technological research, such as the tech sector in Edinburgh and the growing AgriTech sector, that can be supported to bring ideas through which can be seen as a real strength.

Schemes such as Interface and the Innovation Centres programme were seen to be a real strength of Scotland’s research landscape, demonstrated by clear examples of where Government, public bodies and universities have come together to support business to develop research to application. The generation of ideas was also seen as a strength, and the RSE Enterprise Fellowship scheme has successfully generated over 150 companies from innovative ideas.

All attendees agreed that strengths of the research base in Scotland are remarkable for a small country, and quality of life factors mean that Scotland is an attractive place to live and work. The geographical scale of the country means that connectivity and variety of support allows the research base to thrive.

Another strength seen was how flexible Scottish HE has been in the last ten years in being more open to business and business collaborations to ensure that graduates are the most useful and valuable to SMEs in the world of work. The connectivity of people is just as important as research itself, and HE has helped by adding a lens on entrepreneurship and seeing the bigger picture of research outcomes. Business has realised that working with HE can help to scale up their businesses. A strength of Scotland is that it also has a strong sense of social purpose in pulling together business aims to meet societal aims. The Scottish National Investment Bank is the institution for enterprise support with particular social purposes and supporting commercialisation in an inclusive and ethical way.

There have been examples of Scottish universities collaborating in joint submissions to the Research Excellence Framework (REF). Research-intensive Scottish universities have comparable policies on IP to universities like Cambridge. Scotland was also said to have a strong Angel investor network and work was underway in building other types of Venture Capital (VC) investments to support innovation. Big companies would be inclined to set up in Scotland if the quality of available graduates is there.

On non-fiscal examples of support for innovation – many schemes have helped to bring research to the surface and ideas to the attention of VC funders which can help to facilitate engagement with customers. The RSE Enterprise Fellowship has helped to grow cohorts of innovative ideas and facilitate contact with VC investors. It was also said that Scotland is happy to innovate on innovation, both creating new schemes but importantly being unafraid to shut down schemes if they have not worked as desired. The ability to ‘fail fast’ means that lessons can be learned without wasting money.

3. Barriers for the commercialisation of research

It was noted that Scotland has received less investment via HEIF than other UK universities. Scottish support for innovation tends to be more indirect which means that support on research funding is different in Scotland than the rest of the UK. This leads on to the difficult balance of how policy directs public R&D investment and the balance of directed vs unhypothecated research funding. It can be particularly difficult to determine how much of innovation grows naturally and how much is facilitated by directed funding, thus difficult to decide on the balance of funding.

Attendees reflected that if success of academic research is primarily measured by citations, academics will focus on maximising citations from their work. A wider set of metrics of success would allow other benefits of research to flourish. It was felt that Scottish universities have often suffered from focusing too much on league table rankings and the enhanced freedom of other UK universities meant more ideas could be generated and given more time. It was put to the attendees that a degree of anarchy would be beneficial to allow ideas to be generated and flow. This was seen as a major issue for Scotland in being internationally competitive.

The table agreed that Scotland has undersold itself and the strengths of the research landscape and lacks the ‘salesman’ capacity to outline the strength of Scottish innovation. It was felt Scotland must also do more to sell it’s R&D capabilities and strengths in attracting overseas-owned business and to keep them there. There were examples of successful independent research organisations, such as AIRTO, that have had public funding withdrawn but has demonstrated immense value and successes in supporting innovative organisations, but has been undervalued by those outside the sector. The culture of entrepreneurship needs to be promoted in the same way as the culture of science. It was said to be unfair for Scotland to expect that academics can be excellent at teaching, research, bringing ideas to commercialisation and be excellent communicators and could learn from other countries, explored later.

Scotland is trying to improve the horizon scanning for future issues as Scotland better understands how its industry make-up is different than the rest of the UK. This also raised questions about measuring Business Enterprise Research and Development (BERD) data in Scotland and shifting definitions to include what can be considered R&D in the service sector and beyond.

The bureaucracy that comes with getting small amounts of research funding for business was seen as disproportionate. The proportion of matched funding required as part of research grants is also a barrier for small business, where raising matched funding may be less of a problem for larger organisations. Questions were raised over whether this could be tiered to support SMEs. The talent pool in Scotland was seen to be crucial to supporting innovative businesses, but a lack of businesses would mean that Scotland could lose out on highly-skilled graduates who would move away.

It was felt that Catapult Centres can be successful given more time and support in their direction.

It was felt that there was no comprehensive mapping of the Scottish Innovation system to know how to link in to the overall picture or other actors that may be able to collaborate with.

It was noted that issues such as Climate Change have been pushed away from public consciousness because of politicised issues such as the financial crash and Brexit.

4. Lessons to be learned and challenges raised to enhance support for innovation and commercialisation

The question was asked: what can be learned from the Golden Triangle in producing companies? One example raised was the University of Cambridge which has the advantage of a number of large R&D intensive companies, such as AstraZeneca, in close proximity, providing links and collaborations between academia and industry. It was also noted that the University of Cambridge does not hold IP from ideas generated by researchers allowing the ‘spin-out’ of companies to happen more quickly. It was felt that one area that could be improved or receive more attention, is the management of research alongside its development. This is crucial in attracting VC funding to support growth of business.

The point was also raised about how Scottish Government can act as a vehicle for procurement of new technologies to springboard research and support the market? Through these interactions, how can Government drive the entrepreneurial mindset and how can procurement help?

It was noted that Research Excellence Grant (REG) funding provides ¼ of all HE research income and ¾ comes from business and customers. Industry is therefore helping to direct what it wants from HE research. However, business is not static and support networks from public sources need to be dynamic and make sure that it can shift as required to remain visible and ensure innovation can be supported. The German research landscape and infrastructure through Fraunhofer Institutes were established to ensure that customers are happy and innovative research is client-facing. This means the work is designed with business in mind as without clients the Fraunhofer’s would not be successful. It was felt Scotland can learn lessons from the German landscape of different institutions for different types of research and innovation, in business-facing research but also in different types of institutions that were chiefly responsible for different parts of the research and innovation environment.

It was felt that previous vehicles for innovation in Scotland were too focused on protecting IP, whereas new schemes are more focused on people and fostering networks. It was noted that constraints of innovation are related to people and skills and the growth of industries are constrained by the availability of talent. Scotland has a strong research base, but it isn’t necessarily widely known in the public domain. This should be celebrated along with a culture of innovation to show the benefits of Scottish research. It was said to be important to work with young people to promote a culture of innovation and a creative way of thinking.

The challenge was raised as to how best ensure that the continuity of funding was available to support business through scale up. To enable businesses to become beneficial to society and help improve lives, a pipeline of support is required.

5. Closing remarks

The UK Government’s agenda to increase the UK’s R&D intensity to 2.4% of GDP by 2027, combined with the uncertainties caused by Brexit, means that the status quo is set to change. In a new environment for research, it is likely that new winners and losers will be created alongside those currently enjoying success. Disruptions may include overmeasurement and overregulation that could stifle innovation. A flourishing innovation landscape requires Government coordination and for messages to be stove piped across departments, to ensure the smooth integration of immigration, skills, research and environmental interests to support innovation.

It was said that more assessment must be made of how measurements of success drive behaviour in research and innovation, while also ensuring that small changes are easy to support in an agile system. This also means that measurements should not drive perverse incentives. Scotland must be bold and brave to support innovation, in recognising potential and continuing to support schemes and ideas to allow innovation to thrive.

Download the full summary

DownloadRelated resources

This synthesis draws out key policy implications from the findings of a report commissioned by the British Academy and CaSE. The systems-based analysis of the strengths and weaknesses within the UK’s innovation system, ‘From Research to Productivity: A Systems Analysis of UK Innovation Pathways’, was conducted by Cambridge Econometrics.

In 2024, the British Academy and CaSE commissioned Cambridge Econometrics and the Innovation and Research Caucus to conduct this systems-based analysis of the strengths and weaknesses within the UK’s innovation system.

The UK Government published its Industrial Strategy on Monday 23rd June. CaSE takes a close look at what this means for the UK research and development (R&D) sector.

In this submission, we set out a series of recommendations as part of the Government consultation ahead of the 2025 Industrial Strategy.