Dr Martin Turner, Policy and Projects Manager at the BioIndustry Association, examines the healthy indicators from the UK bioctech sector.

UK on track to build the world’s third global biotech cluster

26 Jun 2017

Amongst all the doom and gloom of Brexit, data published by the BioIndustry Association (BIA) this month shows that financing of the UK biotech sector remains strong, with many signs pointing to a bright future. The UK is overtaking its US rivals to become the third global biotech cluster.

Each year, the BIA publishes data on the financial health of our sector. We judge this by how much venture capital funding has been raised by early-stage biotech SMEs, how many are listing on public stock markets (these are usually slightly more mature companies) and how much cash is being raised from other sources.

The UK remains strong despite challenges in 2016

Although Brexit and the US election made 2016 a challenging year of financial uncertainty for all sectors, UK biotech companies secured their second best fundraising performance since the financial crisis.

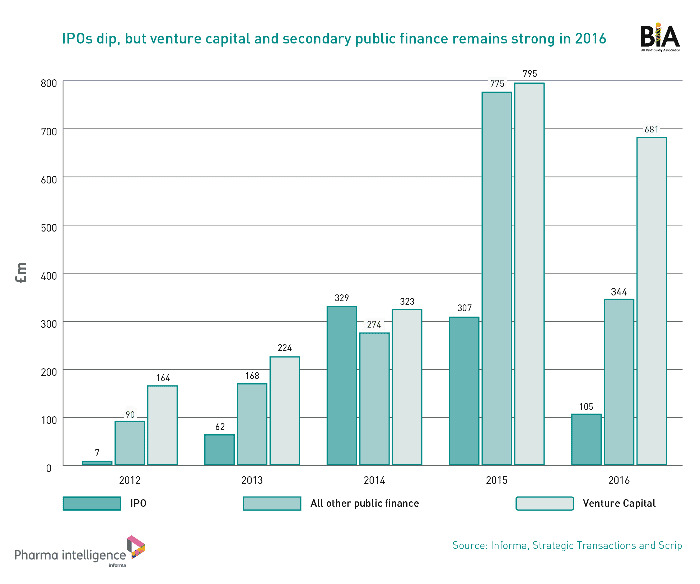

As the graph below shows, there has been a gradual increase in investment in UK biotech and 2015 was a bumper year. Although the stats were down in 2016 compared to 2015, the general upward trend continued and venture capital (VC) funding was particularly impressive, with £681 million raised. This shows that investors are still confident in the UK’s ability to turn the outputs of our science base into successful new treatments and technologies.

The amount of cash raised through Initial Public Offerings of companies on the stock markets (IPOs) was down – likely a result of companies waiting to see what the impact of the EU referendum result and US election would be before making this major move. And cash raised from other public finance sources – primarily on the stock markets – was down on 2015 but continued its gradual long-term trend upwards.

The UK is the clear European biotech leader and is rivalling US clusters

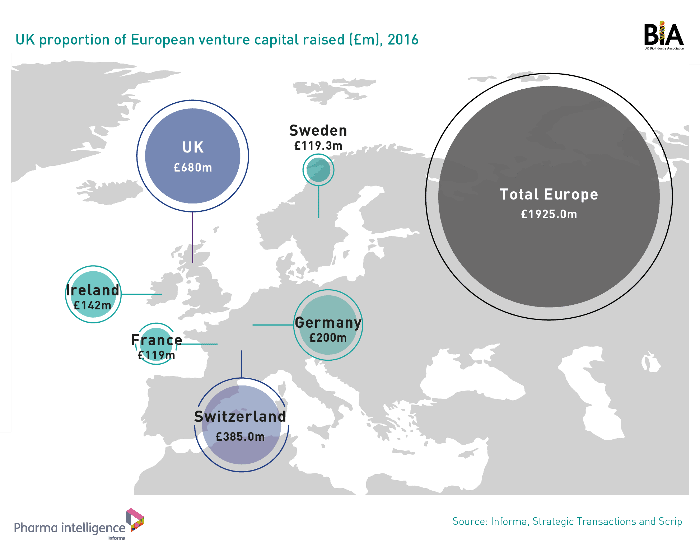

UK companies accounted for more than a third of the total biotech venture capital raised in Europe and more than any other European country. The data also reveal that the combined venture capital of the UK and Switzerland accounts for 55% of the European total. If this trend continues it will mean that more than half of the biotech financing in Europe will be outside of the EU post-Brexit.

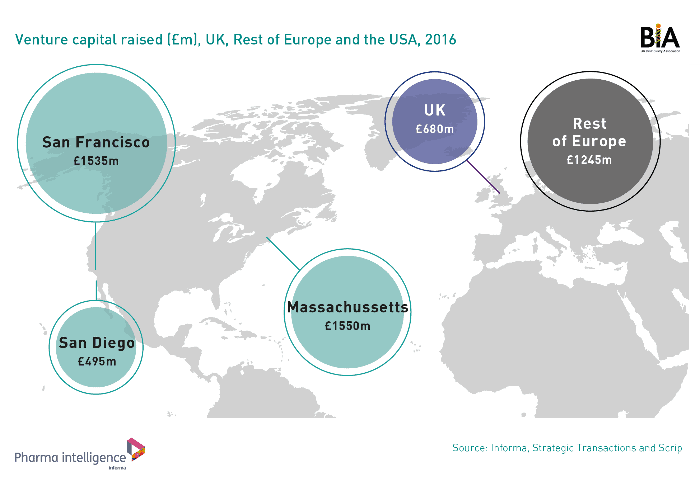

Looking to our competitor clusters in the US, the UK has overtaken San Diego but has some way to go to catch-up with the San Francisco Bay Area and Boston Massachusetts – the long-time biotech behemoths – an ambition we set out in our 2015 Vision.

The future looks bright

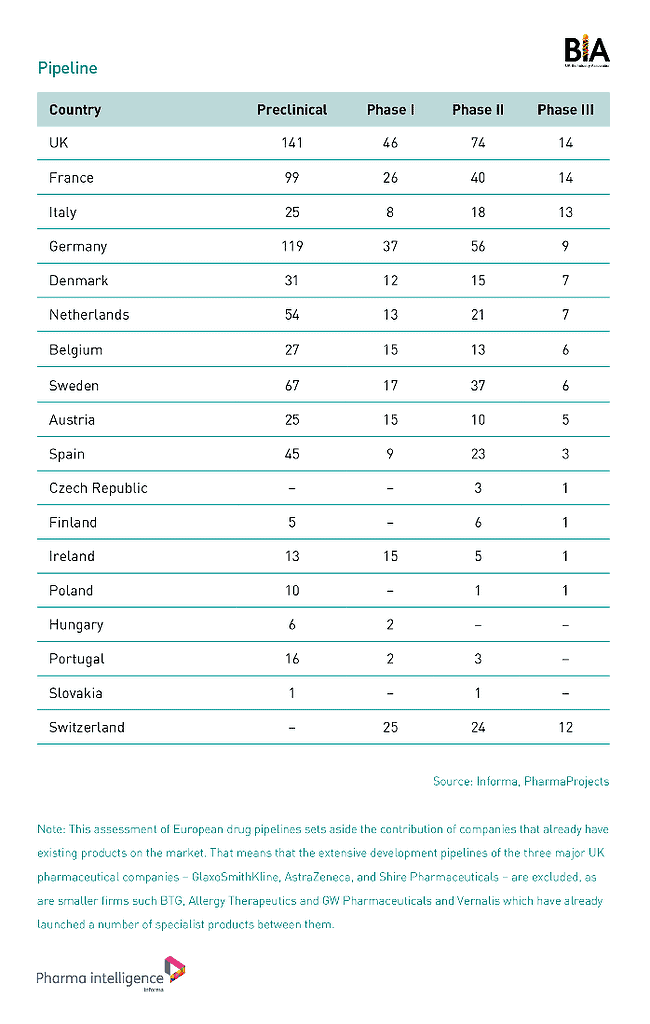

CaSE readers will be familiar with the stats demonstrating the UK’s strong academic science base – 4.1% of researchers, 11.6% of citations etc. – but our data also show the leading strength of our private biotech R&D pipeline. The UK has more products in every stage of pre-clinical and clinical development than any other European country. This strong pipeline will attract future investment and, of course, deliver life changing new treatments for patients.

How to build on this strength

We can’t rest on our laurels. We face significant challenges from Brexit and competition from the Far East and US.

Early agreement in the Brexit negotiations on key issues like a regulatory partnership for medicines, the regime to enable non-UK nationals to work in the UK, and trade rules will be the best way to ensure continued global investment into the UK and EU. It will also be in the best interest of patients who require access to innovative healthcare. The Chancellor’s commitment to bolster the British Business Bank to address the risk of losing investment from the European Investment Fund is a welcome early action that the BIA has been calling for.

There’s a lot the government can do to support our sector through domestic policy. The Industrial Strategy, with its life sciences sector deal, and the Patient Capital Review are great opportunities to build on our strength. These must focus on supporting the UK’s growing innovative SMEs that are commercialising research for economic, public and health benefit.

We need to make available greater sums of scale-up capital – £20-200 million per company – by incentivising the general public, pension funds and sovereign wealth funds to invest in the UK’s innovative industries. Some form of “tech ISA”, modelled on the BIA’s Citizens Innovation Fund concept, is an interesting proposal to explore. But we will need a variety of initiatives to address the scale-up challenge, there will be no one-size fits all solution.

Our response to the government’s Industrial Strategy green paper contains more detail on our prosed polices to build on the strengths of the UK’s biotech sector.

Related articles

Dr Christoph Hartmann is Medical Director, MSD in the UK, a CaSE member. In this piece he sets out he would like to see form the new government to support UK life sciences and innovation.

Dr Martin Turner, Head of Policy and Public Affairs UK BioIndustry Association (BIA), delves into the Government’s proposed reforms of R&D tax relief system and the possible implications.

Emma Lindsell, Executive Director, Strategy, Performance and Engagement on the challenges and opportunities facing UKRI with the latest budget allocations.

Read our latest piece from Isobel Stephen, Executive Director, Strategy, Performance and Engagement at UKRI